Client Resources

Choose the Right Weight:

Paper weight, measured in GSM, affects thickness and quality. Select an appropriate weight based on the printed item and budget, such as 35-55 GSM for newspapers and 110-160 GSM for flyers.

Consider Finishes:

Paper finishes include coated (matte or gloss) and uncoated options. Uncoated paper is suitable for letterhead and stationery, while coated paper offers a modern or high-end look with matte or glossy finishes.

Account for Folds:

Different paper weights and finishes affect how folds are rendered. Lighter-weight paper is ideal for complex folds, while heavier paper may be suitable for items like greetings cards that require stability.

Information Returns (W-2s, 1098s, 1099s, 5498s, etc.)

Penalties increased—Failure to file and failure to furnish penalties and penalties for intentional disregard of filing and payee statement requirements have increased due to adjustments for inflation. The higher penalty amounts apply to returns required to be filed after December 31, 2024. The new penalty amounts are listed below:

- $60 per information return if filed correctly within 30 days of the due date; the maximum penalty is $664,500 per year $232,500 for small businesses)

- $130 per information return if filed correctly more than 30 days after the due date but by August 1; the maximum penalty is $1,993,500 per year ($664,500 for small businesses)

- $330 per information return if filed after August 1, did not file corrections, or did not file required information returns; the maximum penalty is $3,987,000 per year ($1,329,000 for small businesses)

- If any failure to timely file a correct information return or provide a correct payee statement is due to intentional disregard of the filing and furnishing requirements, the penalty is at least $660 per information return with no maximum penalty.

W-2

New box 12, code II, for Medicaid waiver payments excluded from gross income—There is a new code II for box 12 used to report Medicaid waiver payments not included in box 1 of Form W-2.

Military Spouses Residency Relief Act (MSRRA) changes—The Veterans Auto and Education Improvement Act of 2022 enacted on January 5, 2023, changed the residency rules for tax purposes for civilian spouses of servicemembers. Civilian spouses no longer need to have had the same tax residence as the servicemember before relocating in order to keep their prior residence. In addition, for any taxable year of their marriage, servicemembers and their civilian spouses may elect to use the residence of the servicemember, the residence of the spouse, or the permanent duty station of the servicemember, regardless of the date on which the marriage of the spouse and servicemember occurred.

Pension-linked emergency savings accounts—Under SECURE 2.0 Act section 127, employers may add emergency savings accounts to a defined contribution plan to permit employees participating in the plan to make designated Roth contributions that later may be withdrawn subject to certain restrictions. Employers must report these contributions, along with any other designated Roth contributions, on Form W-2, box 12.

Roth SIMPLE and Roth SEP IRAs—Under SECURE 2.0 Act section 601, a simplified employee pension (SEP) arrangement or a savings incentive match plan for employees (SIMPLE) IRA plan may allow an employee to designate a Roth IRA as the IRA to which contributions under the arrangement or plan are made. Salary reduction contributions contributed to Roth SEP and Roth SIMPLE IRAs are subject to federal income tax, social security, and Medicare tax withholding and are included in boxes 1, 3, and 5 (or box 14 for railroad retirement taxes) of Form W-2 and are reported in box 12 using code F (for a SEP) or code S (for a SIMPLE IRA).

De minimis financial incentives—Under SECURE 2.0 section 113, de minimis financial incentives (not paid for with or derived from plan assets) are allowed to be provided to employees who elect to have the employer make contributions under a 401(k) cash or deferred arrangement or elect to have the employer make contributions pursuant to a salary reduction agreement under a 403(b) plan. If an employer provides a de minimis financial incentive to an employee, that incentive is included in the employee’s wages and subject to applicable withholding requirements unless an exception applies.

1042-S

Reporting of distributions of publicly traded partnerships (PTPs)—The requirement to report the PTP’s information with respect to its distribution does not apply to a withholding agent paying a PTP distribution to a Qualified Intermediary (QI) when reporting to the QI in reporting pools on Forms 1042-S with respect to the distribution. This exception also applies to a QI reporting a PTP distribution using reporting pools.

1099-R

Designated Roth nonelective contributions and designated Roth matching contributions—The SECURE 2.0 Act of 2022 permits certain nonelective contributions and matching contributions that are made after December 29, 2022, to be designated as Roth contributions.

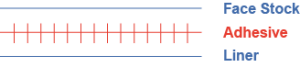

Face Stock

The upper surface of the label maybe made of paper or a synthetic film. The selection will depend on the application. For internal use, the label may be made of a paper material. While outdoor use will have to be a synthetic material in order to with stand the harsh environment.

Adhesive

Just as important to the functionality of the label as the face stock. The adhesive must be chosen with care. The adhesive may be permanent, lumber, removable, freezer. Without the right adhesive the label will not work. On new applications, testing is strongly recommended.

Liner

The liner is coated with a release agent to allow the face stock and the adhesive to be dispensed. Once the label is removed from the liner, the adhesive is exposed and can be applied to the substrate.

Tack (quickstick, quick adhesion, touch tack, quick tack): The characteristic of a pressure-sensitive adhesive which causes it to adhere to a surface instantly with a minimum of pressure. This characteristic holds the label in place until adhesion characteristics develop.

Tamperproof Label (destructible label, tamper evident): A pressure-sensitive construction having low-strength face material and aggressive permanent adhesive. Attempted removal of the label will result in its destruction by tearing.

Ultimate Adhesion: The resistance of a label to removal after adhesion has been allowed to build for a predetermined period of time. The time required to reach ultimate adhesion varies with the adhesive, substrate and labeling conditions, but is approximately 24 to 72 hours.

Ultra-Violet Resistance (UV): The ability of a material to withstand extended exposure to sunlight (ultra-violet) without degradation, hardening, or excessive discoloration.

Underwriters Laboratories: An independent agency for product testing to insure safety standards are met and maintained throughout a products life. All components and packaging must be produced to predetermined specifications.

Varnish (lacquer, clear coat, overlaminate): (1) The vehicle or carrier component of an ink. (2) A thin clear coating that can be applied over printed labels to form a clear protective film.

Water Soluble Adhesive: A pressure-sensitive adhesive in which all components can be dissolved in water.

Weatherability: Capability of a label to withstand the effects of outdoor conditions such as sunlight, heat, cold, humidity, rain, snow and time.

Yellowing: Gradual color change in the original appearance of a pressure-sensitive label, characterized by the development of yellowish and brownish hues.

Zone Release: SEE Patterned Release

Quickstick (tack, finger tack, initial tack, wet grab): The characteristic of a pressure-sensitive adhesive which allows it to adhere to an irregular or cylindrical surface under light pressure. Also a measure of the bond strength immediately after application. To overcome the memory of the facestock and hold the label in place while binding adhesion takes place.

Register: The exact, corresponding placement of successively printed images and/or successive die-cuts into pressure-sensitive labels.

Release: (1) The act of freeing or separating a pressure-sensitive label from its release liner. (2) The force required to free or separate a pressure-sensitive label from its release liner. Can be modified by the coater when coating the carrier (release liner).

Release Coat (release lacquer, lacquer, silicone coat): Material coated on the carrier which allows pressure-sensitive adhesives to release, leave no residue.

Release Liner (backing, backing paper, carrier, liner): The component of the pressure-sensitive construction which functions as the carrier for the label. It protects the adhesive prior to application, and it readily separates from the label immediately before the label is applied to the substrate. Proper liner selection is based on type of face material and use of label.

Release Liner Slits: Linear cuts put in the release liner during coating or on press to facilitate removal of the liner from the label.

Removability: A relative term to describe the force or condition under which a pressure-sensitive label can be removed from a substrate. A removable label is on in which no damage occurs to the substrate or face material. In some cases, when specified, no adhesive residue will be left on the substrate after removal.

Removable Adhesive: An adhesive characterized by low ultimate adhesion and removability from a wide variety of surfaces.

Repositionable Adhesive: A removable adhesive that is designed to maintain bonding properties even after initial use. It does not develop a permanent bond.

Roll Label: Pressure-sensitive adhesives based on natural or synthetic rubbers. Can be coated as a solvent, hot melt or emulsion system. Not recommended for transparent material, UV exposure or high service temperatures.

Service Temperatures (exposure temperature): The temperature range that a pressure-sensitive label with withstand after a 24 hour residence time on the substrate.

Shear Strength (SEE Cohesion): The internal or cohesive strength of the adhesive.

Sheeting: Process whereby rolls of pressure-sensitive base stock are converted into sheets of finished labels by cutting them to the desired length in the sheeting stations on a rotary press.

Shelf Life (storage life): The period of time during which a product can be stored under specified conditions and still remain suitable for use (normally one year).

Silicone (lacquer, release coat): A unique polymer system which can be used as a release coating due to its ability to resist adhesion.

Smudge Resistance: The resistance of a printed or imprinted surface to smearing.

Solvent Adhesives: Adhesive components are dissolved in a variety of organic solvents for coating. Rubber or acrylic based systems can be coated this way.

Solvent Resistance: The resistance of a pressure-sensitive label to the action of specific organic liquids.

Stain: A discoloration of a substrate or facestock caused by contact with a pressure-sensitive adhesive.

Substrate (surface): Normally the surface to which label is applied. Converters also sometimes refer to the facestock being printed as the “substrate”.

Surface Temperature: The temperature factor of substrate or surface to be labeled. Note… if label is applied after content is added, temperature should be determined at that time.

Pattern Gummed Adhesive (strip coater, strip gummed, pattern coater, zone coated): An adhesive coating that alternates strips of adhesive/no adhesive parallel to the machine direction. The areas of no adhesive are frequently used as “lift-tabs” for order picking labels.

Pattern Release (zoned release): Selectively applying alternating strips of release coating/no release coating in a machine direction patter that results in a permanent facestock/release liner bond in the non-release coated areas.

Peel Adhesion (adhesion): The force required to remove a pressure-sensitive label from a standard test panel at a specified angle and speed after the label has been applied under specified conditions(Pressure-Sensitive Tape Council). The strip of a test material is usually one inch wide, and the angle of measurement can be 90 or 180 degrees from the surface. Normally represents the cohesiveness of the adhesive. Also see shear strength.

Perforations: Series of small cuts and ties made in labels and/or their release liner to facilitate tearing along a predetermined line. Also point to fold E.D.P. label products for packaging.

Permanency (degree of adhesion): A measure of an adhesive’s ultimate holding power or bond strength. A permanent adhesive will develop a bond that makes label removal difficult or impossible without destroying the facestock or surface labeled.

Pharmaceutical Litho: A lightweight uncoated litho stock with the flexibility and high performance required for pharmaceutical applications.

Phosphorescent Face Material: A face material coated with phosphorescent ink. Will store light and glow in dark conditions.

Plasticizer (softener): A substance added to plastic materials to impart flexibility, workability and elongation.

Plasticizer Migration: The migration of plasticizers from soft plastics into an adhesive or face material or both. This can cause excessive softening or degradation of the adhesive. “Bleed-through” into the face material may occur, turning the paper face materials translucent.

Polyester: A strong, tear resistant film, having good resistance to moisture, solvents, oils and many other chemicals. Usually transparent, although available with metalized finish. Has high surface energy characteristics.

Polyethylene: A tough, stretchy plastic film having very good low temperature characteristics. Also used a great deal for producing semirigid bottles. Has a low surface energy characteristics.

Polyporpylene: Similar to polyethylene but stronger and having temperature resistance. Has low surface energy characteristics.

Pressure-Sensitive Adhesives: Adhesives that develop a bond to such materials as paper, plastic, glass and wood. No activator is needed to induce bonding other than pressure.

Pressure-Sensitive Label (self-adhesive label): A multiple construction of papers, films or foils and coatings for the purpose of presenting and affixing a message to another surface. A pressure-sensitive adhesive is used in the construction.

Prime Label (primary label): Main product description label.

Primer (anchor coat, barrier coat, sealer coat, tie coat): Coating applied to the face material on the side opposite the printing surface to improve anchorage of the adhesive and prevent migration of adhesive components into face material.

Printing: The on-press act of creating characters, designs and/or pictures on a substrate as opposed to imprinting or imaging.

Process Printing: Multi-color printing utilizing a variety of printing screens, depth of etch, etc., and usually using yellow, magenta, cyan and black inks to give an optical effect of all colors and hues being present in a composite picture.

Protective Coating (SEE Overlaminating): Overprint Coating. A coating that protects the printing and the surface of a pressure-sensitive label from either abrasion, sunlight, chemicals (their fumes and dilute solutions) and moisture, or a combination of these.

Mandrel (SEE Holding Power): Rods of varying diameter and composition used in determining the ability of the adhesive to hold a label to the rod.

Matrix (ladder, skeleton, waste): The face and adhesive layers of a pressure-sensitive construction surrounding a die cut label, which is removed after the label is printed and die cut.

Memory: the inclination of a material to return to its former state after being subjected to change. Flexible materials are said to have little or low memory.

Migration: The movement of one or more of the components of a pressure-sensitive adhesive into either the substrate or the face material; or the movement of one or more of the components of either or both the face material and the substrate into the adhesive or ink.

Moistureproof: The characteristic or coating material which makes a material substantially impervious to water vapor.

Moisture Content (RH Factor): Percent moisture. The moisture present in a material, as determined by specified methods. Improper balance can cause user problems by growth or shrinking of material as moisture level changes.

Moisture Equilibrium: The condition reached by a sample when the net difference between the amount of moisture adsorbed and the amount desorbed, as shown by a change in weight, shows no trend and becomes insignificant.

Moisture Vapor Transmission: A measure of the rate of water vapor transmission through a pressure-sensitive label.

Mold Release Agents: Materials used in the manufacture of molded objects to facilitate their removal from the mold. Mold release agents contaminate adhesives causing inadequate bond strength.

Mottle: Non-uniform coloring or coating of a face material or of the printing on the label. Normally caused by faulty ink.

Opacity: The measure of the amount of light that can pass through a material. Also, the property of a paper or film which prevents “show through” of dark printing, etc., on the substrate. The hiding quality of an ink.

Overlaminating (overcoat): Application of a clear film or liquid lacquer to a label stock for the purpose of protection or to enhance graphic quality.

Overlap: Wraparound labeling of a container in which one end of the label overlaps the other.

Orange Peel: A mottled or textured appearance of a label after being overlaminater.

FDA (Food and Drug Administration): FDA regulations for pressure-sensitive applications apply to the following areas: Adhesives (1) Direct food contact, such as labeling of raw fruits and vegetables (175.125). (2) SEAM contact where incidental contact between an adhesive and a food may be possible (175.180). Facestocks (1) Contact between paper and dry foods (175.180). (2) Contact between paper and aqueous and/or fatty foods (176.170).

Face Material (body stock, face stock): Any paper, film, fabric, laminated or foil material suitable for converting into pressure-sensitive label stock. In the finished construction this web is bonded to the adhesive layer and becomes message part of the construction.

Face Slits: Cuts put in the facestock only during coating or on press to meet specialized end-use requirement.

Fan Fold: Labels produced with perforations in the release liner so the converted web can be folded into flat packs rather than wound in rolls. Generally done where labels will be fed through data processing equipment.

Feathering: A defect which is characterized by ragged, coarse edges in print. Common on uncoated stocks.

Feed Slots: Index holes, index punch, pin feed, line hole punching or marginal punching. Round or rectangular holes or slits put in pressure-sensitive label stock to maintain the register of pressure-sensitive labels while they are being printed or imprinted.

Films: Acetate, polyester, polyethylene, polypropylene, vinyl and other polymeric materials used as facestocks.

Finish: The surface property of a paper or film determined by its texture and gloss. A gloss finish, for example, can be shiny and highly reflective, while a matte finish is generally dull and reflects little light.

Fish Eyes: Round or oval deformations in an adhesive, coating or ink.

Flexibility (memory, conformability, pliability): A property of face materials, measured under specified conditions, that indicates how readily they will conform to curved surfaces.

Foil: (1) A metal foil laminated to a sheet of paper used as a facestock. This is a paper laminate foil and is usually topcoated to improve ink receptivity. (2) A thin metal sheet used as a facestock material.

Food Contact Adhesives: Adhesives meeting specified sections of the Food & Drug Administration Code of Federal Regulations. These regulations cover direct food labeling as well as incidental contact. Special product recommendations are necessary for specific applications.

Fluorescent Stocks: Highly reflective colors used to attract attention. These do not glow in the dark.

Heat Resistance: Property of a material which inhibits the occurrence of physical or chemical changes caused by exposure to high temperatures.

Heavy Coat Weight: Pertaining to adhesives. A higher-than-standard weight of coating per unit area. Normally required for irregular or porous surfaces, and plastics with “low” surface energy.

Holding Power (SEE Mandrel): Ability to withstand stess, as in holding rigid label materials on small diameter cylindrical objects. Involves tack, adhesive, and cohesive strengths.

Hot Mel Adhesive: A printing process in which the image is transferred to a label material by a combination of heat and pressure.

Hot Stamping: A printing process in which the image is transferred to a label material by a combination of heat and pressure.

Image Producing Face: A self-contained, image-producing facestock. Suitable for use with a variety of “pressure” printing methods. Typically used in a forms set.

Imprinting: The after press act of creating characters, designs and codes on the label substrate. In cases of non-impact printing this is called imaging.

Label, Piggyback: A construction with 2 adhaesive and 2 carrier plys. Often required when label face is to be affixed to a form first and affixed to another substrate later.

Label, Transparent: A label whose face material, adhesive and protective coating are optically clear so that an object can be seen through it.

Lay Flat: A carrier material with good non-curling and non-distortion characteristics.

Legging (SEE Hot Melt Adhesive): The stringing out of a pressure-sensitive adhesive. This can occur when the label is being removed from a substrate or release liner or when the matrix is being removed during die cutting and stripping. Normally occurring with hot melts.

Lift Tab (pattern gummed adhesive): Ungummed edge of a label. Designed to make removal from the release liner easier. Sometimes used with order picking labels when gloves or other hand protection is necessary.

Deboss: Condition in which the image is depressed below the normal surface of the label stock. Positive printing generally has a deboss effect.

Delamination: The separation of a material into layers in a direction approximately parallel to the surface. For instance, a facestock separating from the liner during processing.

Die: Any of a variety of tools or devices used for cutting material to a desired shape and/or size.

Die Cut: The line of severance between a pressure-sensitive label and its matrix, made by the cut of a die.

Die Cut Label: A sized and shaped pressure-sensitive label on a release liner.

Dimensional Stability: The property of a material which relates to the degree of its growth or shrinkage, when subjected to variations in humidity.

Dispenser: A device that presents pressure-sensitive labels, either manually or automatically, in convenient units. It often serves as a package for the labels as well.

Double Coated (SEE Self-Wound): A pressure-sensitive product consisting of a carrier material with similar or dissimilar adhesives applied to the two surfaces.

Dwell (residence time): (1) The time during which a pressure-sensitive material remains on a surface before testing for permanence or removability normally 24-72 hours. (2) The time during which a hot-stamp, embossing head, or thermal die remains in contact with the surface of a pressure-sensitive material.

Edge Lift (butterflying, wing up): The tendency of the edge of a label to rise off the surface of the substrate. This condition occurs most frequently on small diametercurved surfaces. Resistance to edge lift is dependent on the initial tack and bond strength of the adhesive and the flexibility of the facestock.

Electronic Data Processing – EDP (data systems): Pressure-sensitive labels produced for imprinting on electronic data processing equipment usually incorporating line hole punching for feeding and cross web perforations for folding.

Elongation (stretch): the increase in length of a material produced by extending it to the point of rupture. (Dictionary of Paper).

Embossed: Condition in which the image is raised above the surface. Reverse printing generally has an embossed effect.

Emulsion Adhesive (aqueous, water based): A dispersion of fine particles or globules in another liquid. Many pressure-sensitive adhesives are emulsion systems, as opposed to solvents and hot melts.

Encapsulated Ink: Ink encapsulated with a coating giving a free flowing dry system which can be activated by heat or pressure.

Exposure Temperature (service temperature): The temperature that a labeled product is eventually exposed to under use conditions.

Back Slits: Linear cuts put in the liner during coating or on press to meet specialized end-use requirements.

Barrier Coats (sealer coat, primer, tie coat): A coating applied to the face material on the side opposite to the printing surface to provide increased opacity to the face material and/or to prevent migration of adhesive through the face material and/or improve anchorage of adhesive to face material.

Bleedthrough (adhesive bleed): Migration of materials from an adhesive or substrate into a face material, resulting in a mottled appearance of the facestock and possibly detrimental effects to the adhesive.

Blocking (SEE ABC Coating): Condition where the labels in a roll stick or transfer image to the backside of the liner above them. Usually due to adhesive cold flow, incomplete die cutting of the adhesive, improper drying of inks or improper drying or curing of coatings.

Break: A term used to denote an end in a roll of face material or release liner. Such points are generally spliced and marked by a protruding flag. Spliced breaks can cause printer problems and missing labels.

Burster: A mechanical device used to burst labels apart at intermediate or fold perforations between labels. Factory must know a label will be subjected to this process in order to furnish the proper cross perforations. Not a recommended practice for label products.

Butt Cut Labels: Labels separated by a single cut to the liner. No stripped area exists between labels. Butt cut labels are not recommended for automatic dispensing or affixing.

Caliper: Thickness, usually measured in mils or thousandths of an inch. A mil is sometimes called a “point”. A 10 mil tag might also be called a 10 point tag stock.

Carrier: SEE Release Liner.

Checking (SEE Crazing): The presence of hairline cracks in a varnish coating, a lacquer coating, or in a film.

Chemical Resistance: The resistance of a pressure-sensitive label (face stock and/or adhesive) to the deteriorating effects of exposure to various chemicals under specified conditions.

Clear Coat: (overcoat, protective coating, varnish): A coating that protects the printing and the surface of a pressure-sensitive label from abrasion, sunlight, chemicals, moisture, or a combination of these. Coating may be detrimental to scanned data.

Coat Weight: The amount or weight of coating per unit area. This is expressed in various units including grams per square meter of pounds per ream.

Cohesion (cohesive strength, internal bond, shear): The internal strength of an adhesive, its resistance to flow, and the resistance to failure by splitting when labels are removed, or under stress.

Cold Flow (ooze): The viscous flow of a pressure-sensitive adhesive under pressure.

Conformability: The ability of a pressure-sensitive label to yield to the contours or flexibility of a surface (curved or rough).

Creep: The lateral movement of a pressure-sensitive label on a surface due to low cohesive strength.

Crazing (SEE Checking): The network of small cracks that can appear in a varnish coat or plastic facestock. Usually caused by a combination of expansion and contraction during weathering or excessive solvent in an ink system.

CSA (Canadian Standards Association): Similar to UL, Underwriters Laboratories of the U.S.A. An agency established to monitor materials used in products to insure product safety.

ABC Coating: Anti-block coating applied to the non-release side of the liner. Designed to prevent ink or adhesive transfer to the backside of the liner. Generally used with film facestocks or heavy adhesive coat weights.

Abrasion Resistance: The degree to which a label facestock – including printing and protective coatings – is able to resist rubbing or wearing away by friction.

Acetates: Transparent and matte cast cellulose films used as facestocks. Not recommended for outdoor uses.

Acrylic Base Adhesive: Pressure-sensitive adhesive based on acrylic polymers. Can be coated as a solvent or emulsion system. Recommended for transparent stock and high heat exposure.

Adhesion (See Permanency): A characteristic in all adhesives; the force required to remove a label from a substrate after a specified period of time.

Adhesive (glue, gum): A substance capable of holding materials together by surface attachment using tack, adhesion, and cohesion properties.

Adhesive, All Temperature: Specially formulated to develop and maintain a permanent bond at both high and low temperatures. Temperatures ranges vary by adhesive. Test should be performed to select an adhesive that meets the need.

Adhesive Bleed: Adhesive elements may migrate into the label stock or labeled surface causing staining or discoloration. Special materials or coatings may be necessary to avoid this condition.

Adhesive Ooze: Results from pressure and/or heat, adhesive oozed from exposed edges and internal perforations or slits.

Adhesive, Cold Temperature: An adhesive that will enable a pressure-sensitive label to adhere when applied to refrigerated or frozen substrates… generally +35°F or colder.

Adhesive, Food Contact: SEE Food Contact Adhesives

Adhesive, High Temperature: An adhesive that will enable a pressure-sensitive label to withstand sustained elevated temperature.

Adhesive, Permanent: An adhesive characterized by having relatively high ultimate adhesion. The label either cannot be removed intact, causes damage to the labeled surface, or requires a great deal of force to be removed.

Adhesive, Removable: An adhesive characterized by low ultimate adhesion. The label can be removed intact from most substrates without damaging the surface.

Adhesive Residue (adhesive deposit): The adhesive remaining behind on a substrate when a pressure sensitive label is removed. SEE adhesive splitting.

Adhesive Splitting: Condition where part of the adhesive remains on the facestock and part on the substrate when the label is put under stress or removed. SEE Cohesion.

Affixer: See Applicator

Anchorage: The specific adhesion of a pressure-sensitive adhesive to face material or an anchor coat.

Anchor Coat: SEE Barrier Coat

Anvil Cut Labels: Steel to steel die cutting. Punched-out or blanked-out labels. A pressure-sensitive label which has been die-cut through all components of the label stock, including liner material.

Application Temperature: Temperature of a substrate and/or label material at the time the label will be applied. Most adhesives have a minimum application temperature rating. Testing is recommended when approaching minimum application temperature.

Applicator: A device that automatically feeds and applies pressure-sensitive labels to a product.

No. 1 : for easy fanfolding : (.43 tooth x .07 space)

No. 2 : for medium fanfolding : (.27 tooth x .062 space)

No. 3 : for bagheaders or folding : (.225 tooth x .15 space)

No. 4 : for folding : (.091 tooth x .25 space)

No. 5 : for medium tear : (.1 tooth x .06 space)

No. 6 : for medium to easy tear : (.05 tooth x .05 space)

No. 7 : for easy tear : (.062 tooth x .038 space)

No. 8 : for medium tear : (.04 tooth x .032 space)

No. 9 : for hard to medium tear : (.74 tooth x .05 space)

No. 10 : for easy tear : (.085 tooth x .035 space)

*recommended for EDP labels

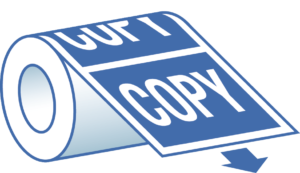

Labels Wound Out

Position 1

Top of copy dispenses first.

(Short Feed)

Position 2

Bottom of copy dispenses first.

(Short Feed)

Position 3

Right side of copy dispenses first.

(Long Feed)

Position 4

Left side of copy dispenses first.

(Long Feed)

Labels Wound In

Position 5

Top of copy dispenses first.

(Short Feed)

Position 6

Bottom of copy dispenses first.

(Short Feed)

Position 7

Right side of copy dispenses first.

(Long Feed)

Position 8

Left side of copy dispenses first.

(Long Feed)

Package InDesign Files:

Lock elements and package the InDesign file to ensure all components are included for the printer’s use. Go to Object > Lock to prevent accidental changes, and File > Package to create a folder with fonts and links.

Choose Print-Ready Format:

Export a press-quality PDF or other CMYK-compatible format based on the printer’s preference. Ensure a minimum of 300 dpi for high-resolution images. Include a bleed and printer’s marks for accurate printing.

Verify with a Proof:

Create a physical mock-up of the document and share it with the printer to clarify complex elements. Request a professional proof for final checking before approving the full print run.

We specialize in a wide range of printing services including marketing essentials, signs and banners, labels, tags, decals, custom apparel, promotional products, plastic products, direct mail, and business documents.

Optimal Margins:

Treat margins like picture frames, providing breathing space for your layout. Print a proof and assess if wider margins would enhance readability.

Trimming Allowance:

Design with trimming in mind to accommodate potential printing errors. Generous margins, ideally .5″ or more, mitigate the impact of slight trimming inaccuracies.

Ensure Readability:

Use appropriate font sizes for legible text. Consider your audience and document type to determine the right size.

Focus on Font Weight:

Choose a font weight that stands out when printed. Experiment with bold or italic weights to draw attention to important text.

Maximize Image Quality:

Use high-resolution graphics for sharp, clear print results. Low-resolution images appear blurry and pixelated.

Choose the Right Format:

Bitmap graphics (JPEG, TIFF, PNG) may lose quality when resized. Vector graphics (Illustrator, EPS) maintain quality when scaled.

Focus on DPI:

Image quality is determined by DPI (Dots per Inch), not file size. Aim for a high DPI (300+) for print layouts to ensure clarity. If necessary, scale down lower-DPI images in your design.

Use CMYK Color Mode:

Set color in CMYK mode for print layouts. Avoid RGB, which is suitable only for digital formats.

Spot Colors:

Include spot colors like Pantone or metallic inks for more precise color matching. Using spot colors requires specialized mixing of inks and production of separate plates for each color, so this method is best suited for very large print quantities, especially those using 3 or fewer colors in total.

Tints vs. Transparencies:

Understand the difference between tints (percentage of color mixed with white) and transparencies (reduced opacity). Tints print as solid colors, while transparencies can result in overlapping colors when flattened.

Choose Your Software:

Use programs like Adobe InDesign, Microsoft Publisher, CorelDRAW, or QuarkXPress for flexible layouts.

Set Trim Size and Bleed:

Set your document to the final trim size and include a .125″ bleed for any elements crossing the page edge.

Consider Folds:

Mark fold locations and double margin space across folds, especially for tri-fold brochures.

Determine Binding:

Discuss binding options like saddle-stitch, perfect, or lay-flat with your printer based on your document type and budget.

Use Reader’s Spreads:

Set up your document for how readers will view it, not how it will be printed, to avoid confusion.

Include Blank Pages:

Add blank pages where needed to indicate structure and accommodate any desired blank pages in the final print.

Absolutely! Our facility is equipped to handle large volumes efficiently, ensuring quality and timely delivery.

We utilize state-of-the-art printing technology and conduct thorough quality checks throughout the printing process to ensure high standards.

Yes, our creative design team can work with you to create layouts and designs for any project we print.

Turnaround times vary by project complexity and volume. We strive to meet your deadlines and can provide more accurate estimates upon project discussion.

We accept various file formats, including but not limited to PDF, AI, and EPS. For specific requirements, please check our submission guidelines or contact us.

You can request a quote through our website by providing details about your project or contact us directly for personalized assistance.

While we have specialized solutions for the industrial, B2B, and financial sectors, our services are adaptable to meet the needs of any industry.

Absolutely, we ensure consistency with your brand standards across all printed materials, from design to the final product.

Downloadable PDFs

Explore essential documents for new and returning customers, all available for download as printable PDF documents.